The right CIBIL score will never get your loan request rejected

Table of Contents

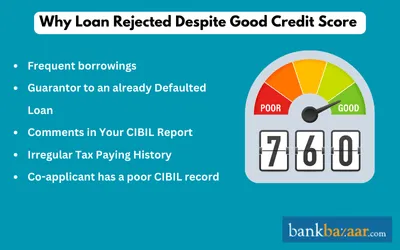

Your CIBIL score plays a crucial role in the approval of your loan applications. A high CIBIL score, which is in the range of 700 to 850, is more likely to attract lower interest rates and faster approvals for your loans.

TransUnion CIBIL Limited is the credit rating agency that monitors and maintains your credit records. This helps lenders in assessing your credit worthiness before approving your loans.

How does CIBIL determine your credit score

CIBIL considers the following factors to calculate your credit score:

- High Credit Utilization: CIBIL considers your credit utilization ratio to calculate your score. A high credit utilization implies an increasing debt which may affect your credit score.

- Repayment History: If you fail to repay your EMIs (Equated Monthly Installments) on time, your CIBIL score will automatically reduce.

- Multiple Enquiries: CIBIL also calculates your score by monitoring your number of loan enquiries. The back-to-back credit enquiries imply an increase in financial obligations in future.

- Credit Mix: If you have availed a mixture of secured and unsecured loans and have been regular in your repayments, your CIBIL score is likely to increase. This is because CIBIL determines that that you are capable of managing various types of loan options in a financially responsible manner.

What most people don't know about CIBIL?

Banks and other financial institutions provide loans after checking your CIBIL score. You should have a score of at least 750 to avail a loan from a bank or any other financial institution. Let us have a look at the factors which affect your CIBIL score:

- High Credit Utilization Rate: A high credit utilization rate will badly impact your CIBIL score as the lenders consider that you are using the credit to reduce your financial stress. Thus, it is always recommended to use less than 25% of your credit limit to maintain a good CIBIL score.

- Duration of Credit Record: The lenders can easily check your financial history if you are in the credit system for a longer period. This will help them to monitor your credit management skills.

- Loan Repayment: Lenders will also take into account whether or not you are repaying your loan on time. Your CIBIL score will negatively impact if you are not paying your loan as per the schedule.

- Applying for Multiple Loans or Credit Cards: The lenders will conduct an enquiry each time you apply for a loan or a credit card which can affect your CIBIL score. So, once you apply for a loan, you need to take a gap of at least three months to apply for the next credit product.

- Outstanding Debt: The lenders also monitor the outstanding debt that is recorded in your CIBIL report. Non-payment of EMIs on time will increase your debt amount which will negatively impact your CIBIL score. Therefore, to maintain a healthy CIBIL score, you have to clear your outstanding debt.

The best way to keep your CIBIL score high

The following are the tips to keep your CIBIL score high:

- Pay your outstanding debt on time.

- Avoid applying for loans or other credit products frequently.

- Make sure to use only 25% to 30% of your credit limit.

- Pay off your credit card bills or loan EMIs on time.

- Do not deactivate any unused or old credit cards.

- Monitor your CIBIL report regularly.

Read More on CIBIL

- Tread with caution before co-signing a home loan

- Loan approval on CIBIL Score

- Correlation between Credit Rating and Debt

- Does Personal Loan and Credit Card Helps Credit Score?

- Low credit limit despite a high income?

- How Making Minimum Payments Can Affect Credit Score?

- Having a high CIBIL score can get you a lower rate of interest

- CIBIL score calculation

- Tips for good CIBIL Score

- CIBIL Score Required For Credit Card

- CIBIL Login and Registration

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

CIBIL Score Requirements for Loans

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.